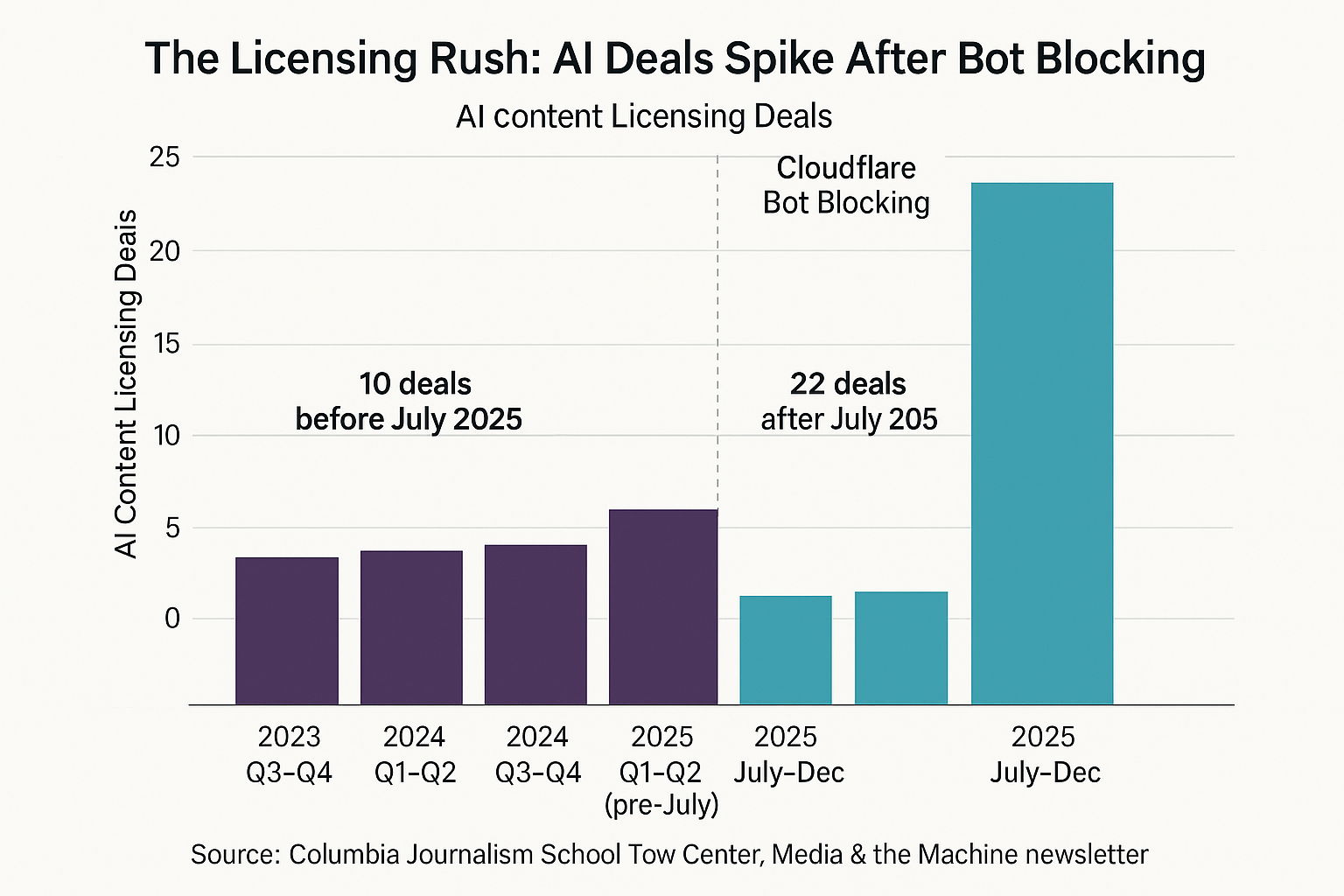

The numbers are in, and they’re staggering: AI companies have signed more content licensing deals in the past six months than in the previous two years combined. Between July and December 2025 alone, 22 major licensing partnerships were announced—more than double the 10 deals signed from mid-2023 through June 2025.

What changed? The answer reveals a fundamental shift in how AI companies approach content rights—and why every publisher, blogger, and creator needs to pay attention.

The Cloudflare Catalyst

In July 2025, Cloudflare launched its bot blocking and pay-per-crawl infrastructure, giving website owners unprecedented control over AI access to their content. The timing wasn’t coincidental. According to data tracked by Columbia Journalism School’s Tow Center for Digital Journalism, which maintains a comprehensive tracker of AI licensing deals, the announcement marked an inflection point.

Before July 2025: 10 major deals

After July 2025: 22 major deals

The message was clear: free crawling was ending. AI companies needed legitimate access to quality content, and publishers finally had leverage.

The Billion-Dollar Players

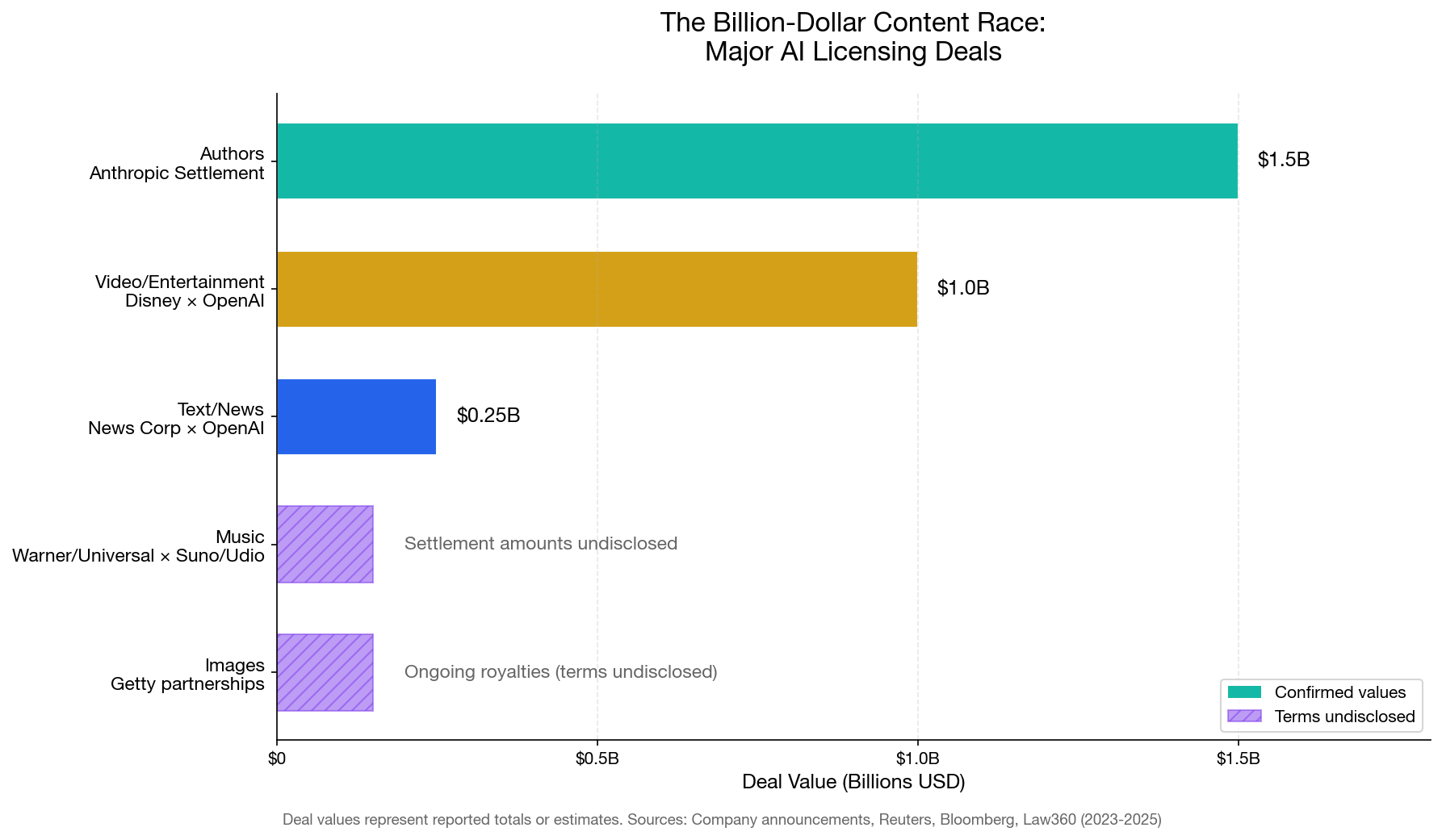

The scale of recent deals demonstrates just how valuable content has become to AI development:

Entertainment: Disney’s $1B Bet

On December 11, 2025, Disney announced a landmark $1 billion investment in OpenAI, licensing over 200 characters from Marvel, Pixar, and Star Wars franchises for OpenAI’s Sora video generation platform. The three-year deal allows users to create AI-generated videos featuring beloved characters—with curated selections appearing on Disney+.

“This is where 2026 is heading,” notes Ty Martin, CEO of Copyright.sh. “Licensing becomes the engine of quality. AI platforms with access to strong, recognizable IP will cut through the slop trough, while unlicensed or generic content is lost.”

News & Publishing: The OpenAI Media Empire

OpenAI has assembled the most extensive publisher network in the industry:

- News Corp: $250M+ over 5 years (May 2024) for Wall Street Journal, Barron’s, New York Post, and international properties

- Dotdash Meredith: People, Better Homes & Gardens (May 2024)

- Axel Springer: $25M+ for Politico, Business Insider (December 2023)

- Financial Times, Le Monde, The Atlantic, Vox Media, TIME and more

Music: From Lawsuits to Licensing

The music industry’s pivot from litigation to licensing happened remarkably fast:

- Warner Music Group × Suno: Settlement and partnership announced November 2025, following $500M copyright lawsuit

- Universal & Warner × Udio: Settlement with plans for new AI subscription service in 2026

- All three major labels (Sony, Universal, Warner) filed lawsuits in summer 2024, then quickly moved to licensing deals

Authors: The $1.5B Anthropic Settlement

In fall 2025, Anthropic agreed to a $1.5 billion settlement with a class of authors, representing one of the largest copyright settlements in AI history. The Authors Guild served as a formal partner with class counsel, advising on publishing contracts and ensuring authors received their fair shares.

The Meta Media Blitz

In December 2025, Meta entered the licensing arena with a flurry of multi-year deals announced within days:

- CNN

- Fox News

- Le Monde Group

- People Inc.

- USA TODAY Co.

- The Daily Caller

- Washington Examiner

According to Axios, these agreements allow Meta to access real-time content for its Meta AI chatbot, providing users with verified news and current events. The move marks Meta’s return to compensating news companies after backing away from such deals several years ago.

Microsoft’s Publisher Content Marketplace

Not to be outdone, Microsoft launched its Publisher Content Marketplace in September 2025 with launch partners including:

- Financial Times

- Reuters

- Axel Springer

- Gannett (October 2025)

- Condé Nast

- Informa ($10M+, May 2024)

The marketplace model represents a systematic approach to licensing, moving beyond one-off deals to a platform-based solution.

The Court Cases Driving Change

Legal pressure accelerated the licensing rush. Key cases shaping the landscape:

New York Times v. OpenAI & Microsoft

Filed December 2023, this lawsuit alleges that OpenAI used millions of Times articles to train ChatGPT without permission or compensation. The case is ongoing and represents one of the highest-profile copyright challenges to AI training practices.

Getty Images v. Stability AI

Getty’s lawsuit, filed in both US and UK courts in January 2023, claims Stability AI trained on millions of Getty images without licensing. The case highlighted the legal risks of unlicensed datasets and helped launch Getty’s “commercially-safe” licensing program with recurring royalties for creators.

Dow Jones & NY Post v. Perplexity

These cases target AI-powered search and answer engines that quote extensively from copyrighted sources. The Chicago Tribune recently joined the lawsuit against Perplexity in December 2025.

According to legal tracking, over 50 copyright infringement lawsuits have been filed against AI companies since 2023, with approximately 30 active cases remaining after consolidations and settlements.

The Search Traffic Collapse

Why are publishers suddenly willing to license? Because AI is devastating their core business model.

One study from April 2025 found that Google’s AI Overviews feature reduced traffic to outside websites by more than 34%. Some publishers report drops approaching 80% for AI-cited content that doesn’t generate clicks.

As Will Scott notes: “Publishers are striking these deals for visibility, attribution, and compensation as AI-generated summaries have led to nearly an 80% drop in website clickthroughs.”

When your primary revenue source—traffic—is collapsing, licensing becomes existential rather than opportunistic.

The Fortune 500 vs. Everyone Else

Here’s the uncomfortable truth: these mega-deals prove the market exists, but they leave smaller creators in the cold.

As PCMag observed: “All of these deals have one unfortunate thing in common: They leave out smaller sites that can’t afford lawyers to negotiate with the likes of Google and Meta.”

The bifurcation is stark:

- Fortune 500 publishers: Multi-million dollar licensing deals, legal teams, ongoing negotiations

- Independent creators: No seat at the table, content used anyway, zero compensation

News Corp gets $250 million over five years. Your blog gets crawled for free.

Enter the Licensing Standards Movement

This gap is exactly what’s driving the emergence of licensing infrastructure for the open web:

Really Simple Licensing (RSL)

Announced in 2025, the RSL Collective’s standard dictates which parts of a website AI crawlers can access without completely blocking them. Cloudflare, Akamai, and Fastly have adopted RSL, backed by Yahoo, Ziff Davis, and O’Reilly Media.

Creative Commons AI Licensing Support

In December 2025, Creative Commons announced tentative support for AI “pay-to-crawl” systems, recognizing that such infrastructure could help smaller publishers participate in licensing revenue.

Platform Solutions

Startups like ProRata.ai and TollBit are building AI licensing marketplaces specifically designed for publishers who lack the resources for direct negotiations.

What This Means for Your Content

The 32 major deals announced since mid-2023 prove three things you need to know:

1. The money is real. AI companies will pay billions for licensed content access. The question isn’t whether licensing is viable—it’s who gets compensated.

2. Negotiating power matters. Disney gets $1 billion. News Corp gets $250 million. Your blog? Nothing—unless infrastructure emerges to level the playing field.

3. The window is closing. Every day your content remains unprotected is another day of free training data. As one publisher executive noted: “AI intermediaries pose an existential risk… early licensing arrangements are likely to be the most lucrative as models continue to accumulate foundational knowledge.”

First-mover advantage applies to licensing too.

The Copyright.sh Approach: Democratizing AI Licensing

The Fortune 500 publishers negotiating eight-figure deals prove that AI companies recognize the value of quality, licensed content. But what about the billions of web pages created by individual bloggers, independent journalists, technical writers, and small publishers?

That’s where standardized licensing infrastructure matters.

Copyright.sh lets any creator to:

- Set licensing terms via meta tags – One line of HTML code establishes your AI licensing policy

- Generate discoverable ai.txt files – Machine-readable licensing that AI systems can check before crawling

- Track usage through MCP integration – Know when and how AI systems use your content

- Collect fair compensation – Automated royalty tracking and payment flows

The same licensing rights that Disney negotiates with teams of lawyers—available to any creator with a website.

What Comes Next

If 2024 was the year AI companies realized they needed licenses, 2025 was the year they started paying for them. What does 2026 hold?

More standardization. Expect industry-wide protocols for AI licensing discovery, similar to how robots.txt became universal for search engines.

Smaller creator access. Licensing infrastructure will expand beyond Fortune 500 negotiations to platform-based solutions accessible to individual creators.

Regulatory pressure. The EU AI Act’s text-and-data-mining opt-outs mean compliance becomes non-negotiable for companies operating internationally.

Quality differentiation. AI platforms with access to licensed, high-quality content will deliver better outputs than those scraping unlicensed web junk. Licensing becomes a competitive advantage.

The Bottom Line

Thirty-two major deals totaling billions of dollars prove one thing: AI companies know they need licensed content, and they’re willing to pay for it.

The question is whether that compensation flows only to massive publishers with legal teams—or whether licensing infrastructure emerges that lets every creator participate in the AI economy.

Disney’s $1 billion deal doesn’t threaten small creators. It validates them. If Mickey Mouse is worth licensing, so is your blog post, your tutorial, your analysis, your creative work.

The licensing revolution is here. The only question is whether you’ll participate in it—or just fund it with your free content.

Ready to protect your content? Start with one meta tag. Learn how at copyright.sh/how-it-works.

Leave a Reply